Exorbitant costs have made college life a real financial burden for many students. Tuition, housing, and other expenses such as textbooks and technology, leave students with huge sums of debt.

Financial stresses have driven many students to hold multiple jobs, greatly decreasing the time to study and participate in extracurricular activities. Some are even discouraged from pursuing college due to the cost.

This issue is addressed by advocating for policies of affordable tuition, increasing access to scholarships and grants, and supporting financial literacy programs that would help students manage their expenses effectively.

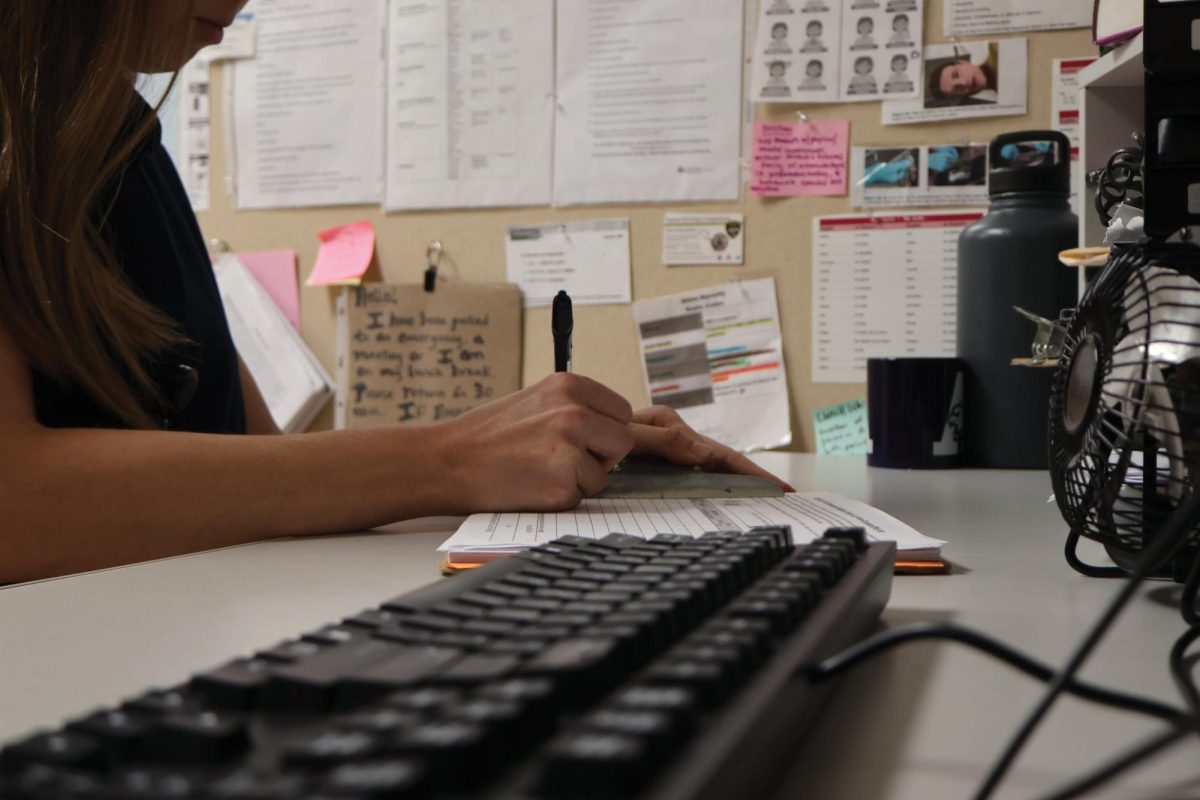

The Eagle’s Eye interviewed Hamza Bouderdaben, a college advisor with AdviseTX College Advising Corps, to question what Akins students should be doing to begin applying for financial aid.

The Eagle’s Eye: What steps should students take if FAFSA becomes no longer available?

Hamza Bouderdaben: “If FAFSA stops accepting applications, it’s usually like it’s too late for your application to be submitted to the university. You know what I mean, you can still submit an application, but by then, the decision and deadline for the university has passed, so there’s no relevance. You’re not going to get any money towards your education. I would say if you wait that long, your only hope is external scholarships, or maybe waiting for the next cycle, next admission cycle, and finding intermittent work in the meantime.”

Are there any temporary financial aid options available while waiting for FAFSA to process?

“FAFSA is the main one. You can go to the institutions themselves. Usually when you apply, you are automatically considered for their scholarships. So I would look around and see if they have any external scholarship applications through the university. If they do, you want to put those in as soon as you can.”

What advice do you have for students who suggest taking out loans to cover college expenses?

“I always recommend federal loans are always better than private loans. So if you’re going to take out loans, go to FAFSA first and take out federal loans. If you’re going to take out private loans, you’re going to want to do your research. You’re going to want to pick the best interest rate that stays consistent. A lot of the time, private loans are offered through banks that offer really low rates for the first four years of college, and then as soon as you’re out of college, those rates spike up, and it gets very, very expensive. So if you’re going to do federal loans, I would prioritize subsidized loans over unsubsidized because subsidized those interest rates are capped. They are locked. So no matter what, you’re always gonna be paying 7% interest, even 20 years down the line, if God forbid, 20 years down the line, you’re still paying.”

How can students budget effectively to cover their college expenses?

“I’m going to say this honestly as a college student, Hey, man, you got to learn how to cook. You got to learn how to cook more than just ramen. You have to find good options for you, like, if you’re in Austin, wheatsville co-op had pretty cheap prices for me. H-E-B had pretty good prices for me. I would always be attending social events with free food that was honest to god my dinner or lunch. Sometimes you gotta learn how to budget by basically finding expenses that are

unnecessary that you can cut without living too much like a Spartan with no fun, if that makes sense.”

Are there any community resources or organizations that offer financial support?

“Yes, there are hundreds. I would prioritize looking at the university, first, the financial aid office, their student Emergency Services Office. Then I would go into basically just Google search for local orgs near you that can offer financial advising, that can support you through your college endeavor, sometimes through scholarships, the really good scholarships, they will offer you counseling for help with that money expenses. But if they don’t, or if you didn’t get a scholarship like that, I would recommend sitting down with your advisor in college or academic advisor, and asking them for their input, because they oftentimes get students coming in with a lot of finance questions even though they’re not there to answer finance questions. They’re usually there to help. They’ll do what they can.”