Simmons: FAFSA ‘life line’ to college funds

At this time of the year, most students have already submitted their college applications and probably already been accepted to a college or university. But some students don’t know what comes next.

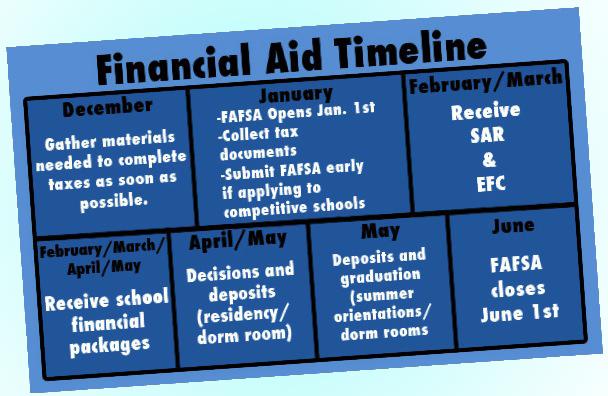

How are you going to pay for college? Every year, the federal government opens up FAFSA applications for high school seniors in January.

FAFSA stands for Free Application for Federal Student Aid. It is a way for students to receive financial assistance so that they would be able to pay for college the upcoming year.

“FAFSA makes college a reality,” college adviser Celina Artusi said.

Since most high school students do not have much money saved up for college, FAFSA is a great opportunity to get some financial assistance to help reduce college expenses that students would otherwise have to personally provide money for.

FAFSA is “your life line to getting into college,” college adviser Sarah Simmons said.

FAFSA applications open up on January 1 so students should start preparing for them during the last days of December. Some documents that are needed to complete the FAFSA application are: your parents 2013 tax return form, W-2’s, driver’s license number, Social Security number, permanent address, and all of that same information for the parents.

If you do not have a social security number, don’t worry you can still qualify to get some financial help. For students who do not have a Social Security number, another option would be to fill out the TASFA, which was specifically meant for students who do not have a Social Security number.

There are four types of financial aid: scholarships, grants, work-study, and loans, which are all beneficial to a student. All of these opportunities will be available for a student once they fill out the FAFSA application.

Students, however, should not expect the FAFSA to provide all of the money they need for college.

“Ninety percent of your financial support for college” is provided by the FAFSA, Simmons said.

“Depending on if you have your documents in line, FAFSA applications take about 20 to 30 minutes,” Simmons said.

It does not take a long time to fill out the application so students should definitely fill it out as soon as they can.

“I recommend students to continue to apply for scholarships in addition to the FAFSA to lessen the burden of paying for college,” Artusi said.

“I recommend students applying to competitive schools or out of Texas schools need to submit their FAFSA using their 2012 tax return form ad then update heir FAFSA’s in February with 2013 tax return information,” Simmons said. “However, most other students need to submit February 1st using 2013 numbers.”

Because college is a serious and expensive place to go, students should take advantage of the financial assistance that FAFSA applications are offering. It is definitely worthwhile, Simmons said.

“The only reason that I got through college is because I qualified for loans with FAFSA,” she said.

Another thing that students need to know is that the FAFSA is free. If a website or somebody asks you to pay a small fee then it is probably illegitmate.

FAFSA is 100 percent free so students should be wary of scams out there. Students who have any questions or concerns are advised to speak to the college counselors if any questions about scams arise.

Your donation will support the student journalists of Akins High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

12th grade

Academy :

T-Stem

Year on staff :

This is my first year on staff.

Newspaper Role :

Staff writer.

Why on staff ?

I'm on staff because I like to write stories and take pictures.

What do you do for fun?

I love to play soccer and play video games

Plans after high school ?

I am interested in going to Texas State University and earning a Master's degree in Accounting.

12

Academy :

ACES

Year on Staff :

First Year

Newspaper role : Staff Writer

Why on staff?

To inform and to entertain.

What do you do for fun?

Collect sneakers.

Plans after high school?

Go to a 4 year university and major in Business.