Recent banking scams affecting students

Nathan Willis, assistant branch manager of the A+FCU branch at Akins poses with a prop debit card by the A+FCU building. Willis wants Akins students to know about scams students have fallen for.

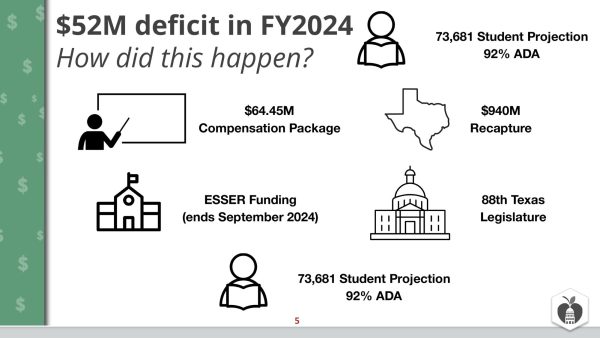

Young people are often described as “digital natives” who grew up with the Internet and are thus less likely to fall for the kinds of online scams to which older people with less experience online fall victim. But it turns out that this is just a stereotype that is not supported by the data.

Younger adults reported losses to online shopping fraud – which often started with an ad on social media – far more often than any other fraud type. Younger adults were over four times more likely than older adults to report a loss to investment scams like bogus crypto currency investment opportunities. And this age group reported losing money on job scams at more than five times the rate of older adults.

Students at Akins have started to be victims of scams happening to A+ FCU debit card holders as well.

Nathan Willis, assistant branch manager for the A+FCU branch, shared his concerns about these scams to help students stay safe.

“Prevention Prevention Prevention. My best recommendation is reach out and escalate when something seems off to you. This can be a parent, a teacher, it could be A+; we’re here for you. If it seems too good to be true, remember fast money is most often bad money,” Willis said.

There are multiple types of scams going on such as card cracking, check cashing, sugar daddy/mommy, online gaming and job scams.

Senior Sheylene Ibarra is apart Carlos Garcia law class . If you fall for one of these, you can be the one in trouble and then you can face legal problems just because you’re old enough to fit in. I think it’s important for people to know that” she says. Ibarra has also fallen for a scams. She didn’t know the trouble she could get into by turning in a fraud check. Her account ended up getting frozen.

In 2021, Gen Xers, Millennials, and Gen Z young adults (ages 18-59) were 34% more likely than older adults (ages 60 and over) to report losing money to fraud, according to a report by the Federal Trade Commission published in December. These scams could be extremely harmful to a persons future.

If one day in the future you would want to open an account with a different bank, if they see that you have had a bad credit score, the reason wont matter.

Some tips to avoid being scammed are:

Before you buy, do your research with a trustworthy source. One of the best ways to avoid scams is to verify the offer and avoid making snap buying decisions.Don’t believe everything you see. Scammers are great at mimicking official seals, fonts, and other details. Just because legitimacy by going to BBB.org and looking up the company yourself. website or email looks official does not mean it is. For example, if a business displays a BBB Accredited Business seal, you can verify its legitimacy by going to BBB.org.

Your donation will support the student journalists of Akins High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Academy: AHA

Number of Years on Staff: First year

Title: Staff writer

Why do you enjoy being on staff? taking pictures

What do you do for fun? annoy my friends

What are your hobbies? Dance

Hopes & Dreams after high school? get a masters degree in criminal justice

Hidden Talent: nothing

Twitter handle: don't have one