Seniors Express Need For a Financial Literacy Education

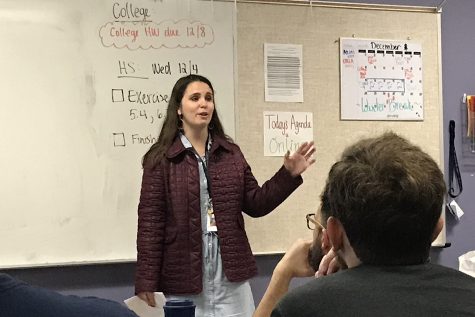

Branch manager Marla Carter and senior Mitzy Martinez work at the bank desk. Interns work after sixth period.

October 8, 2019

Credit, debt, interest, assets, bonds, dividends and variable rates.

These are important terms needed to successfully navigate the world of money, and currently, there is no required class for all students that helps them learn these concepts.

Some of these concepts are discussed in economics or money matters math classes, but there is often not enough time to discuss financial literacy with students to the level that will help them manage their money after high school.

Some students said they benefited from parents who helped them teach them about handling and saving money. Senior Aracely Tellez said she had her first job when she 13 years old. Before that, she already had an idea of how to manage her money well because of lessons her parents gave her.

“My parents have raised me to be really aware of what I’m doing with my money, making sure that I’m saving it when I need to,” Tellez said.

Some students said these days aren’t really aware of how to wisely manage their money and most students have jobs and haven’t had training on how to live on a budget.

“I don’t think I’m prepared to be able to manage my money correctly after high school for my lack of knowledge of financial literacy,” senior Jennifer Ramirez said.

Ramirez plans to go to college next year and worries she is not prepared to manage her money before she enters a new chapter in her life where she will be expected to live more independently.

Tellez said she saved some money for emergencies and was able to help her parents financially. She’s not alone. Many teenagers are trying to balance school and a job to help their parents.

A tip that Tellez and Ramirez suggested was would be helpful is to start a savings account like $5 – $20, a little goes a long way.

One advantage that Akins students have is the on-campus branch of the A+Federal Credit Union. Teaching financial literacy is part of the credit union’s mission.

It’s very important that kids understand how to have a college fund even if it’s just $5 to start you out. It’s a big difference.

— Aracely Tellez

When students first open an account with A+ the staff teach them about the basic things that the students should be aware of like the difference between a credit and a debit card and how to avoid overdraft fees.

The local branch managers also try to help on campus by conducting classroom presentations.

“We can give presentations to their classes over anything from budgeting,” said Ally Rushing, assistant branch manager.

The presentations also help students learn how to budget, how to avoid scams, and what it takes to live independently.

Some students said they appreciate the help that A+

provides, but they would like to have a required course on personal nance, especially before they leave high school and are required to live on their own.

“It would be more than helpful for a class on money management on campus, especially for seniors,” Ramirez said.

Tellez said she hopes students will take money management seriously so they start on in life on the right foot.